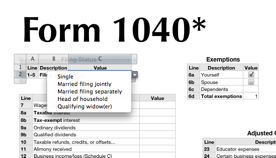

Federal 1040 helper as Numbers spreadsheet

Below you will find the IRS’s Federal 1040 form in a completely unofficial, completely at your own risk spreadsheet template worksheet for iWork’s Numbers application. As you fill in each line, it updates an estimate that might be similar to what you might owe or be refunded from federal United States taxes. This year, only the main F1040 form is “complete” although there is a very simplified part of Schedule C that hooks in as well.

You can download the template and try it out. It is licensed under a Creative Commons Attribution, Share Alike license so feel free to share any corrections or additions.

As I’ve posted before, I quit my job at the end of last year. In preparation, my wife and I were trying to estimate where we might be at financially this year. I love Numbers, so I put this together to help get a more solid estimate of our tax liability. While I was preparing this year, it also helped me see by how much deductions would affect the bottom line. Of course, this is no substitute for the official forms or the advice of a certified accountant. Don’t trust this form, but please do let us know if you find any errors. Either leave a comment for everyone, or if you want to send attachments my email account with yahoo.com is “natevw”.

Speaking of the official forms, another piece of advice: On both of my work computers, Preview.app has two frustrating, er…deficiencies I’ve encountered when filling out the PDF tax forms. First of all, if I use “Save as” to keep my work it instead *clears* my work and I end up with two blank PDFs. I think a hearty EPIC FAIL is in order here. When I try to work around that by printing to a PDF instead, it often crashes halfway through printing and I end up with one blank and one corrupted PDF. So the advice? Do all your official figuring on good old paper printouts and pencil. If you do want it in digital form, copy the values into the spiteful electronic nemesis when you’re all done. Then if (WHEN!) it tries to subvert you, you needn’t waste time recalculating.